- Sep 18, 2025

- 8 min read

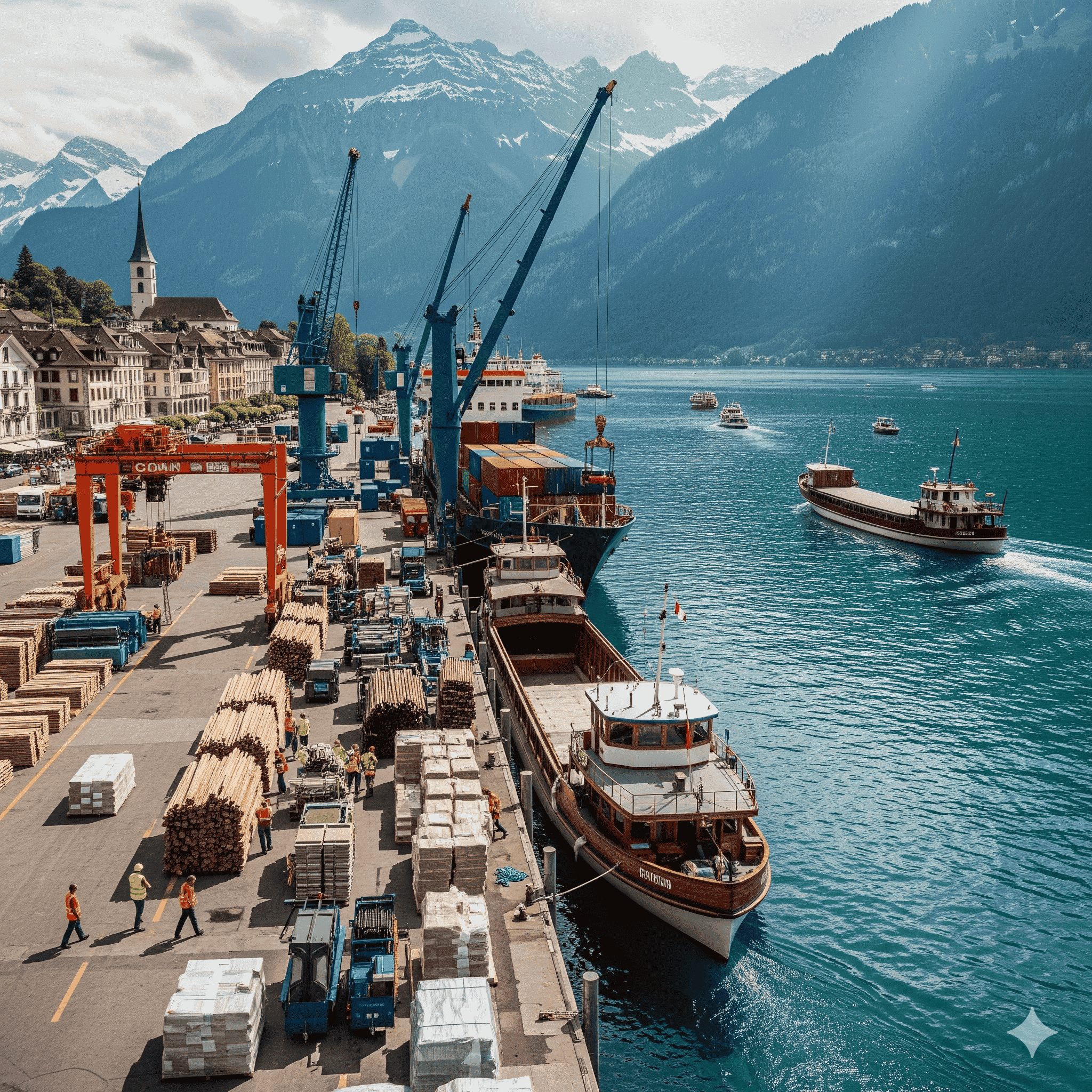

Trade Flows Disrupted: Swiss Exports to U.S. Plummet After Tariffs

In August 2025, Swiss exports to the United States dropped sharply—by approximately 22% compared to July—following the imposition of 39% tariffs by the U.S. administration. This decline reduced shipments to the U.S. from nearly CHF 4.0 billion in July to around CHF 3.1 billion in August, marking one of the steepest monthly pull‑backs in years. †

These tariffs, announced in early August, targeted many Swiss goods, excluding certain categories like pharmaceuticals and gold. Switzerland, heavily reliant on exports for economic growth, found this a sudden and severe disruption. The tariffs are believed to affect about 60% of Swiss exports to the U.S.—including watches, machinery, and chocolate—goods that form the backbone of Switzerland’s export economy. †

While Swiss goods to the U.S. plunged by over one fifth, overall Swiss exports in August showed much smaller change: nominal total exports fell by only about 1% compared to July, and when adjusted for real (inflation‑adjusted) values, exports were up by about 2.4% versus the previous month. † This divergence underscores how concentrated the damage was in U.S.‑bound goods. Other trading partners—including countries within the European Union and Canada—picked up some of the slack, helping to buffer the impact on the broader export numbers. †

Which Sectors Were Most Affected?

The swings in trade flows hit several sectors especially hard. The watch industry—long one of Switzerland’s iconic export industries—faced sharp declines in U.S. orders. Machinery and precision instruments also saw reduced demand. While pharmaceuticals and gold were mostly exempt, the exclusions could not fully counterbalance the losses in other categories. †

Chocolate and luxury goods—goods often exported in smaller, high‑value batches—aren’t exempt from disruption either. Even where tariffs do not directly apply, the uncertainty, increased cost of logistics, and questions about U.S. demand lead many firms to delay shipments or negotiate new terms of sale. †

Swiss Government Response & Negotiations

Facing what many officials describe as an “economic blow,” the Swiss Federal Council has scrambled to respond. With affected exports forming a major portion of Switzerland’s trade, the government has sought to re‑open trade negotiations with the U.S., promising to present a “more attractive offer” to Washington. †

Federal economists warn that without mitigation, the tariffs could reduce Swiss GDP by between 0.3% and 0.6% in the short term. If the excluded sectors (especially pharmaceuticals) were to be affected or if disruptions spread, the contraction could exceed 0.7% or more. † Long‑term effects might include reduced foreign demand, supply chain changes, and reduced competitiveness in U.S. markets. †

Broader Impacts & Trade Destinations Shifts

One consequence of the U.S. tariffs is that Switzerland’s exports to alternate markets have picked up. European Union countries and Canada have shown stronger demand, helping offset some loss. As U.S. demand shrank, German demand rose, and Germany overtook the U.S. as Switzerland’s top export destination in certain categories for the first time in recent months. †

However, shifting market focus isn’t a fast remedy. New contracts, regulatory compliance, and shipping/logistics adjustments take time. Companies dependent on U.S. clients must cope with cash flow challenges, inventory backlogs, or losses, especially when goods are perishable, seasonal, or require rapid turnover.

Advice for Businesses Amid Uncertainty

- Audit your product lines to identify which are directly subject to the new U.S. tariffs and which are being indirectly impacted by cost or demand shifts.

- Negotiate with customers and suppliers to mitigate immediate cost blows—consider adjusting prices, payment terms, or delivery schedules.

- Seek alternative markets to reduce dependency on the U.S.—whether in the EU, Canada, Asia, or emerging economies.

- Explore supply chain adjustments: increasing domestic production where feasible, or sourcing inputs from nations not subject to new tariffs.

- Model potential cost scenarios using tools like the USA Tariff Calculator (free)—to understand margin impacts and inform pricing decisions.

The recent drop in Swiss trade with the U.S. serves as a warning: tariffs can shift trade dynamics quickly, disrupting established markets. For Switzerland—a high‑cost, high‑quality exporter—maintaining competitiveness will depend on agility in strategy, smart negotiation, and proper risk management.

For exporters, staying on top of fast-moving tariff changes is critical. Use the USA Tariff Calculator to estimate how these new tariffs affect your products’ costs, pricing strategies, and market access.

Sources

- “Swiss exports to US drop over a fifth after Trump tariffs” — Reuters

- “Switzerland scrambles to ink trade deal with US amid certain 'economic blow' due to tariffs” — Euronews

- “Swiss exports to US plunge 22% in August amid tariffs” — Investing.com

- “Swiss exports to the US fell sharply after tariffs came into force” — BGNES

- “Swiss exports to US plummet in first month of Trump tariffs” — Swissinfo