- Sep 18, 2025

- 8 min read

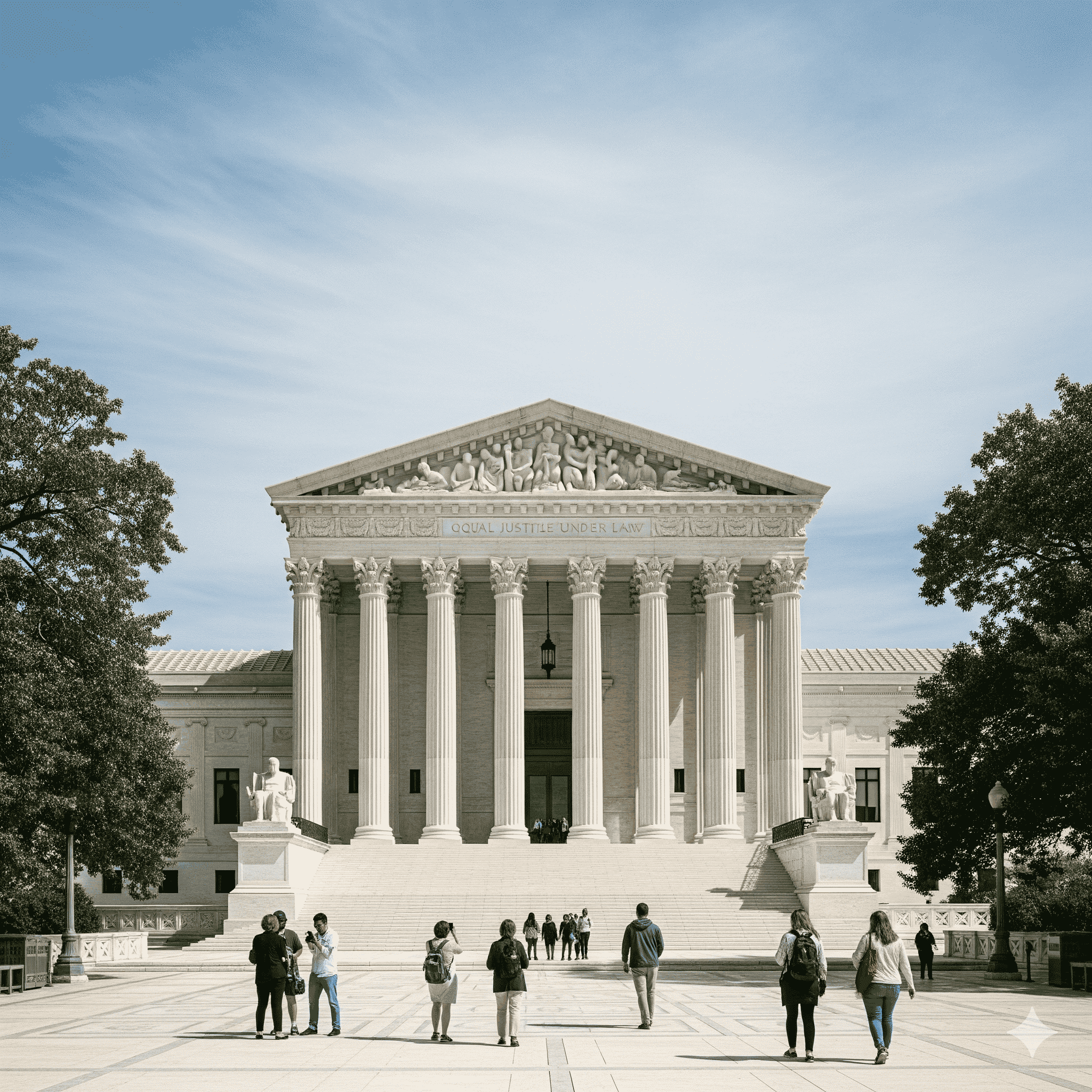

Legal Battle Looms as Supreme Court Prepares to Review Trump’s Broad Tariffs

In September 2025, the U.S. Supreme Court set November 5 as the date to hear arguments concerning the sweeping global tariffs imposed by the Trump administration under the International Emergency Economic Powers Act (IEEPA). These tariffs, including the so-called “reciprocal” tariffs which apply broadly, and the “fentanyl” or trafficking‐related tariffs aimed particularly at China, Mexico, and Canada, have prompted a series of legal challenges. †

On August 29, 2025, the U.S. Court of Appeals for the Federal Circuit issued a 7‑4 decision stating that President Trump had exceeded his authority under IEEPA. The court ruled that while IEEPA empowers the president to act in the face of “unusual and extraordinary threats,” it does not explicitly grant power to impose tariffs or duties. Those powers have traditionally been understood as legislative functions, requiring statutory clarity. † Because of this ruling, the government’s IEEPA‑based tariffs are under legal scrutiny. However, the implementation remains active for now due to a court‑ordered stay which delays full enforcement until at least October 14, 2025. †

The case originates from multiple plaintiffs including states, businesses, and other trade entities who argue that the President’s use of IEEPA to impose general tariffs constitutes an overreach. One key case, V.O.S. Selections v. United States, saw the Court of International Trade rule that these tariffs were unlawful. That decision was paused while the appeal to the Federal Circuit proceeded. † Another related case, Learning Resources, Inc. v. Trump, similarly challenges the scope of the emergency powers when used for economic policy rather than traditional national security emergencies. †

One critical question before the Supreme Court is the interpretation of the phrase “regulate importation” in IEEPA. Proponents of the tariffs argue that this phrase provides a broad mandate that includes imposing tariffs under emergency conditions. Critics counter that “regulation” traditionally implies non‑tax measures—such as trade licensing, import bans, or restrictions—not duties or taxes, which are considered legislative acts. The distinction matters because the U.S. Constitution grants Congress the power to impose duties, tariffs, and taxes, not the executive branch. †

Another doctrine at issue is the “major questions doctrine,” which requires that when a policy has vast economic and political significance, Congress must clearly authorize it. The Federal Circuit’s majority opinion suggested that imposing broad tariffs under IEEPA without explicit language crosses the line under this doctrine. Opponents say that using emergency powers to impose sweeping tariffs risks unchecked executive authority and could set precedent for future administrations to bypass Commerce or Trade Acts. †

What Is the Legal Basis for These Tariffs?

The Executive Orders central to this dispute include EO 14193, EO 14194, EO 14195 (trafficking/fentanyl related) and EO 14257, EO 14266 (reciprocal/global tariffs). Each attempts to use IEEPA‑declared emergencies to justify imposing duties. These Orders define the scope of goods affected, often targeting imports from countries perceived to contribute significantly to trade deficits or to facilitate drug trafficking. Under EO 14257, for example, a blanket duty is imposed on many imports with higher rates for certain nations. These Orders are drafted to assert that trade deficits themselves constitute emergencies, and that drug trafficking is sufficiently connected to national security to justify immediate action. †

The Court of International Trade in V.O.S. Selections described the Orders as “extraordinary” in scale and argued that Congress did not intend IEEPA to serve as a general trade law. It noted that previous administrations have used other statutes—such as Section 232 (national security) or Section 301 (unfair trade practice)—when imposing tariffs, rather than relying on general emergency powers. †

Practical Impacts for Businesses and Importers

For companies importing goods into the U.S., the current situation is deeply uncertainty‑laden. Even while appeals are underway, the tariffs remain in force due to court stays. That means importers must continue paying duties, calculating costs, and accounting for potential future legal changes. Many are adjusting pricing or prompting renegotiations with suppliers. Some importers are front‑loading orders to avoid potential shortages or cost spikes if legal decisions force back payments. †

Among sectors particularly affected are electronics, consumer goods, apparel, and industries dependent on raw materials from countries under high tariff rates. Logistics operations are strained by unpredictability, customs delays, and compliance burdens. Small to medium enterprises (SMEs) that lack legal, trade‑expert staff are often more exposed, with fewer buffers to absorb cost shocks. Some multinationals are looking for alternative supply chains—either shifting manufacturing to non‑tariffed countries or increasing domestic sourcing where possible. †

On the financial side, tariffs collect revenue for the U.S. Treasury, which in turn has implications for federal budget projections. But if the Supreme Court rules parts of these tariffs unlawful, refunds or rebates may be demanded for overpaid duties, which could increase liability for the government. Equity and fairness issues arise: businesses that paid duties under orders later struck down may push for retroactive relief, while those that delayed imports pending clarity may suffer missed opportunities. †

Ramifications for Trade Policy and International Relations

These legal developments may reshape how U.S. trade policy is conducted. If IEEPA is constrained by the Supreme Court, future presidents may lean more heavily on traditional trade statutes, and Congress could consider explicitly amending IEEPA to clarify what is and isn’t allowed under emergencies. Failure to clarify could result in repeated legal challenges. †

Global trading partners are already reacting. Some countries subject to the reciprocal tariffs have begun exploring legal or diplomatic pushback; others are adjusting their export strategies away from the U.S. but risk losing market access or being penalized under U.S. trade laws. Tariff reversals or reductions might lead to countermeasures or renegotiations in trade agreements. †

What to Watch Going Forward

- How the justices on the Supreme Court frame the issue of statutory clarity for emergency powers. Are they likely to emphasize prior interpretations of IEEPA that focused on sanctions vs. trade?

- Whether there is strong dissent or concurring opinions previewed in filings that suggest limits on presidential power under constitutional doctrines such as nondelegation or major questions.

- The timeframe for a final judgement after oral arguments. Quick decisions may lead to abrupt economic shifts. Delays may prolong uncertainty.

- Possible congressional action to either codify tariff authority under emergency statutes or to restrict future uses of those powers.

- Responses from states, businesses, and trade partners: legal challenges, trade rebalancing, shifts in import/export flows, and diplomatic efforts.

Understanding what a tariff means for your products is critical amid this legal uncertainty. If you're an importer, exporter, or business affected by U.S. tariffs, try the USA Tariff Calculator to see how current or potential tariffs may impact your costs.

Sources

- “US Supreme Court to hear Trump’s tariffs case on November 5” — Reuters

- “US courts weigh Trump's tariff powers: a critical examination of IEEPA appeals” — Reuters

- “US Supreme Court to decide legality of Trump's tariffs” — Reuters

- “Trump takes tariffs fight to US Supreme Court” — Reuters

- “U.S. courts weigh Trump's tariff powers” — Reuters

- “Trump tariffs may remain in effect while appeals proceed, US appeals court rules” — Reuters